or possibly moron food safety:

I'm really not bothered. I have never gotten sick from my own cooking and very, very rarely from restaurant cooking. I use raw eggs all the time. You can pasteurise eggs by holding them at 57C internal for two hours. The proteins haven't denatured so it still looks and works exactly like a raw egg. I never do that because I use good eggs and also don't care. YMMV.

I eat rare beef, pink pork, pink poultry. I love oysters. I've gotten violently ill from bad oysters but they are worth it. I've gotten sick a few times from restaurant food. This can be down to poor hygiene by the food handlers or it can be from bad ingredients improperly cooked or tainted raw veg.

If you are nervous about food pathogens for whatever reason -- and some people have very good reason to be -- but still don't want to overcook things, definitely study the pathogens, study the time vs. temp data, get a good thermometer, and be disciplined in your cooking.

07 December 2013

Cooking to Internal Temperatures: Duration Matters

I don't remember where I found this chart [apologies, kudos, and thanks to the originator] but it illustrates a key concept in cooking that many home cooks are ignorant of: "safe" internal temperatures when cooking depend on duration.

Usually "official" recommendations for food cooking give just a temp at which most pathogens would perish instantly and at which the taste and texture of your food also perish instantly. The government doesn't care how your food tastes, they are optimizing for reduced illness. And companies don't want to get sued because you got sick. I don't want to get sick, either, but I'm honestly not that bothered. I do want my food to taste good and I don't want to go to the expense of sourcing really good meat to eat only to ruin it by cooking it too long.

The chart above is a simplification. The poultry curve is for salmonella. Certainly there are other pathogens that might be in poultry. And I've looked at the raw [heh heh] data from FSIS, and the other simplification is that the curve changes depending on factors such as %fat of the poultry in question. But the chart is perfect for illustrating the temperature and time aspect of cooking safely.

So the FDA says to cook your chicken or turkey to internal of 165F, which is horrible thing to do to a good breast. On the previous post, Joe mentioned he got much better results cooking to 160F (for 3min). A few degrees can make a big difference. So can a few minutes.

What the chart tells me is that if, say, I'm smoking chicken at a relatively low temperature, and thus it is taking a long while to cook, and if the lowest internal temp is 62.5C at a given checkpoint, I can pull it off in 15 minutes regardless of what the internal temp is then. So if I wanted to take it off the heat at 65C, I would go with either 65C or 15 minutes elapsed, whichever comes first.

Cooking isn't always about the lowest temperature possible. For delicate items or ones that dry out easily -- poultry white meat, pork loin, good steak, most fish -- I err on the low side. For other items, I cook them to much higher temperatures not out of safety concerns but because I think they are better that way. Best examples: goose leg confit (all poultry legs, for that matter), pork shoulder (pulled pork), various braising cuts and such.

Bottom line: if you want to avoid overcooking a particular piece of meat, think of duration when it comes to internal temperatures.

There's plenty of good information on the web about food safety. Douglas Baldwin, for example, has a really nice introduction to it, written as part of a sous vide primer but of good general interest.

01 December 2013

Sous Vide Turkey Breast

For Thanksgiving this year I cooked the turkey breasts sous vide, to rave reviews and enthusiastic overconsumption. For years I've been cooking the breasts and legs separately, usually roasting the breats on the bone. Last year for boxing day I also tried an herb-brined smoked turkey breast on the bone, which was excellent. This year for thanksgiving I broke down the turkeys, made stock out of the backs, breastbones, and wings, separated legs and thighs and roasted those, brined the boneless breasts, then cooked them sous vide before finishing under the broiler with plenty of butter. I plan on doing the same next year.

I used boneless breasts from 2 turkeys.

brine overnight, about 15-16 hours

rinse, dry, & bag each with a hunk of butter then cook sous vide @ 61C for 3.5 - 4 hours

To finish, coat with butter and put under broiler, skin side up, until skin is dark brown and crispy.

I used boneless breasts from 2 turkeys.

brine overnight, about 15-16 hours

from Ruhlman & Polcyn's Charcuterie:4l water

350g salt

125g sugar

42g pink salt

2 bunches fresh tarragon

5 cloves garlic, crushed with flat of knife

a couple bay leaves

20g black peppercorns

(note for next year: some sage and/or rosemary might be nice)

rinse, dry, & bag each with a hunk of butter then cook sous vide @ 61C for 3.5 - 4 hours

To finish, coat with butter and put under broiler, skin side up, until skin is dark brown and crispy.

Chocolate Ice Cream using Cocoa, Assured Nut-Free

I wanted to make a nice chocolate dessert for one of our Thanksgiving guests who is highly nut-allergic but I could not find any brand of chocolate bar that was willing to put a stake in the ground about being nut-free. I did find that Bournville [a Cadbury brand] cocoa is assuredly nut-free, so went with that.

I really wanted to try a chocolate ice cream but I lost patience about 90 seconds into googling. Every chocolate ice cream recipe with cocoa also had chocolate in it. So I invented my own. It was really good, and very well received. Here it is:

125g cocoa

400ml whole milk, used in 2 portions, 220ml + 180ml

400ml double cream

200g sugar

5 egg yolks, beaten

1t vanilla

pinch salt

(1) in large bowl, mix 125g cocoa & 220ml cold whole milk together into a smooth paste

(2) it's hard to resist tasting it at this point, so go ahead

(3) immediately regret tasting it

(4) heat the remaining 180ml of milk + the double cream, off heat at or before it reaches boil

(5) whisk hot milk/cream into the cocoa/milk mix (if this doesn't combine well for any reason, it should be fine to return it to low heat and stir until smooth consistency)

(6) whisk in the sugar & a pinch of salt

(6) whisk in the egg yolks & vanilla

(7) strain into a clean bowl, thoroughly chill, then put it into your ice cream maker

I really wanted to try a chocolate ice cream but I lost patience about 90 seconds into googling. Every chocolate ice cream recipe with cocoa also had chocolate in it. So I invented my own. It was really good, and very well received. Here it is:

125g cocoa

400ml whole milk, used in 2 portions, 220ml + 180ml

400ml double cream

200g sugar

5 egg yolks, beaten

1t vanilla

pinch salt

(1) in large bowl, mix 125g cocoa & 220ml cold whole milk together into a smooth paste

(2) it's hard to resist tasting it at this point, so go ahead

(3) immediately regret tasting it

(4) heat the remaining 180ml of milk + the double cream, off heat at or before it reaches boil

(5) whisk hot milk/cream into the cocoa/milk mix (if this doesn't combine well for any reason, it should be fine to return it to low heat and stir until smooth consistency)

(6) whisk in the sugar & a pinch of salt

(6) whisk in the egg yolks & vanilla

(7) strain into a clean bowl, thoroughly chill, then put it into your ice cream maker

22 September 2013

Opera Mission

In for a penny, in for a pound: went to Covent Garden last night to see our first opera and pulled out all the stops. We aimed for maximum accessibility, Mozart's Marriage of Figaro.

It was lovely. The Royal Opera House is just a fantastic venue. We didn't know quite what to expect but overall it was much more relaxed and engaging and flat-out pleasant an experience than I would have guessed. Everything was nice, starting with the welcoming staff at the doors, followed by some friendly assistance inside as we took a moment to get oriented, then settling gently into the evening with pre-show charcuterie and cheddar & chutney sandwiches in the grand, airy, and buzzing Paul Hamlyn Hall Champagne Bar.

First question in the ROH FAQ is on dress code. There is none. There were some folks dressed extremely nicely, and others in jeans. The crowd was excited, enthusiastic, and expressive. Quite a while ago I'd been to see the Chicago Symphony Orchestra and while the performance was outstanding, the experience was overwhelmingly stuffy and uptight, which was the fault of the audience entirely and not the musicians. Maybe it's changed in recent years. Or was an aberration. I hope so. (Chicagoans normally bring to bear a refreshing midwestern groundedness.) Or maybe it's cultural. I've gone for a bit of the symphonic at Royal Albert Hall and found it to be a pleasantly joyful occasion. (Maybe Londoners are just that awesome.)

The performance was wonderful. More engaging, to the point of engrossing, than I'd expected. Moments of comedy, a bit of tension, and quite a lot of sadness. Figaro's taunting of Cherubino in Act 1 for getting commissioned into the military was done with such gleeful mocking that it was downright mean. The song, "Non più andrai", is a crowd pleaser, and was given a whimsical translation in the supertitles ("no more buzzing about, bothering the ladies").

Supertitles! Yeah, they were easy to read, unobtrusive, and the whole thing was really easy to follow. While quite a lot of the music was familiar for a variety of reasons (seen Trading Places?), I didn't bother listening to anything or reading up on the story beforehand. Not necessary.

The confusion at the end of Act II was delightful. The supertitled "(everyone is confused)" was well received at a very specific moment. I think it's only a matter of time before someone projects "(WTF?)" there.

The Countess is the character in the saddest role. Even the "forgiveness" at the end is more resignation to her lot than reconciliation. The Act III "Dove sono" by Maria Bengtsson, in which the Countess wonders where all the love and joy has gone and why, if the good has gone, the memories of happiness still remain, was beautifully sung and just heartbreaking.

Long before Act IV was in full swing I was well and truly hooked. The whole spectacle was pretty astonishing. Yeah, I kind of knew it wouldn't be people just standing around bellowing out arias, but that's not the half of it. Opera again? Oh yeah!

31 August 2013

Management Skills

I've identified a key management skill: Tactical Forgetting. There are some things a manager doesn't need to know, and if a team accidentally provides too much transparency, their manager can benefit from tactical forgetting.

Which leads me to a corollary observation: any sufficiently advanced management technique is indistinguishable from senility.

Which leads me to a corollary observation: any sufficiently advanced management technique is indistinguishable from senility.

20 August 2013

18 August 2013

Observationally, Are We Getting Dumber?

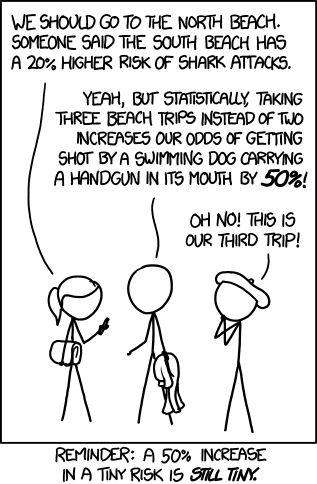

|

| http://xkcd.com/1252/ |

Two problems. XKCD perfectly describes one, which is that a relative risk increase is just about useless if you don't know the absolute risk. The other side of the problem: where do these risk values come from?

In 2001, Oxford Journals' International Journal of Epidemiology published "Epidemiology--is it time to call it a day?". Six years prior to that Science published "Epidemiology Faces Its Limits". So, 12-18 years later, have we gotten smarter about epidemiology?

Nope.

Maybe it's the amount of data or accessibility or ease of publishing or the disappearence of professional editing, but bad or trivial or meaningless stats and probabilities seem more common than ever. Our risk assessment skills seem just as bad as ever.

Two helpful guidelines for understanding any risk metric you see:

- assume it's not from a controlled trial (in other words, assume it's low quality)

- remember guidance from actual epidemiologists, from the 1995 article [emphasis mine, and keep in mind that, say, a "20% higher risk" is a relative risk of only 1.2]:

As a general rule of thumb," says Angell of the New England Journal, "we are looking for a relative risk of three or more [before accepting a paper for publication], particularly if it is biologically implausible or if it's a brand new finding." Robert Temple, director of drug evaluation at the Food and Drug Administration, puts it bluntly: "My basic rule is if the relative risk isn't at least three or four, forget it." But as John Bailar, an epidemiologist at McGill University and former statistical consultant for the NEJM, points out, there is no reliable way of identifying the dividing line. "If you see a 10-fold relative risk and it's replicated and it's a good study with biological backup, like we have with cigarettes and lung cancer, you can draw a strong inference," he says. "If it's a 1.5 relative risk, and it's only one study and even a very good one, you scratch your chin and say maybe.

11 August 2013

Sous Vide Chili, Shortribs, and Chicken Breasts

Next post will not be about cooking, I promise.

Beef Short Ribs, Again

After the highly successful 72 hr, 55C shortrib trial, I decided to go for a more traditional braise texture. I smoked a slab of shortribs for a couple hours until they were near or at 50C, then cut them into individual ribs, bagged each, and put them into the water bath at 62C. I tried the first after 24 hours. It was tender and very good. The rest I left in for 48 hours. Even better! Very much a traditional braise texture -- flaking nicely, tender, moist -- quite different than the tender steak-like texture of the 55C version. They were not falling off the bone, but easy to eat without knife and fork. Rib meat should require a bit of pull to get off the bone anyway. To serve: coated with bbq sauce and popped under the broiler until browned and crispy.

Chili

While I had the aquarium going, I made a few bags of chili. Old-school Texas style chili: no onions, no tomatoes, no beans. Just brisket, beef fat, dried chilies, and salt. I picked up five bags of whole dried chili peppers from borough market and came up with a method for turning them into a chili paste:

- stem, seed, and roughly chop the peppers

- steep them in hot water from a kettle for 15 minutes or so, then drain

- poach them in rendered beef fat over low heat for a while, then puree the whole thing

For the meat I used a brisket flat, which went into the smoker for a couple hours, then I pulled it out and cubed it. Had to trim quite a bit but still ended up with plenty of beef. I coated the smoked, cubed beef with the chili paste and added salt, then divided between three bags. In they went -- 62C for 48 hours.

Result: really good! The bitterness went away, the chilies rounded out and mellowed out and blended beautifully with the beef. The beef got tender and the whole thing turned into a lovely, slightly fiery, smokey chili stew. Worth doing again. And I had extra chili paste I later used to make a more common pot of chili (with ground beef and tomatoes and onions).

Chicken Breasts

Well this was easy. I cut up a couple chickens, smoked the legs and wings, saved the carcasses for stock, and bagged the boneless breasts for a first sous vide chicken trial. (Incidentally, the smoked wings made fantastic buffalo wings later: crisped them in a smoking hot pan with butter, then coated and sauteed in a mix of equal parts butter and frank's hot sauce.) The chicken breasts went into the aquarium for 2 1/2 hours at 60C and turned out just about perfectly. One of them I just browned skin-side in a hot pan with butter. The other I didn't even bother, just cut it up for another dish. It's odd in that it goes against expectations. I normally do a perfectly good job of cooking chicken no matter what method I use, but here I still expected the thin end to be overdone. It wasn't of course. It was just as perfectly tender and done as the thickest part. Brilliant.

Cooking Broccoli: High Heat, No Water

|

| with chicken and cheddar |

I found this here: http://www.thewednesdaychef.com/the_wednesday_chef/2008/08/heston-blumenth.html

and it's my new favourite way to cook broccoli. Quick, easy, great results.

I use a cast iron frying pan. Basically:

v high heat, add some olive oil [smokin' hot]

broccoli in, lid on, don't touch it for 2 minutes

after two minutes: salt & pepper, some butter, shake it all about, lid back on, still high heat, don't touch it for 2 minutes

is it done? if not, leave it on another minute or two, otherwise it's ready to eat

Chocolate Ice Cream

Trying to get a suitably chocolatey ice cream is like doing titration quickly. You want to worry yourself that you've gone too far in order to hit the point that's just perfect. This is my modified version of "Ben's Chocolate" from the classic Ben & Jerry Ice Cream book from 1987 -- richer, less sugar, more choc (more egg, heavier cream, slightly different ratios, different instructions). I love it, but this will be too much for many people.

140g 90% dark chocolate [I use Lindt]

240g whole milk [I used a rich jersey & guernsey milk]

2 eggs + 1 add'l egg yolk

120g sugar

240g double cream

1t vanilla extract

pinch salt

method

chop chocolate and put in bowl

heat milk in microwave until almost boiling

pour hot milk over chocolate and let sit for a couple minutes

stir milk & chocolate together, should be smooth and melty now [if it is not smooth and melty, you should either panic or cry, or panic then cry, or threaten it with the microwave until it complies]

in separate bowl, which eggs&yolk

whisk in sugar

add dbl cream, vanilla, a hearty pinch of salt and whisk together to mix

mix chocolate into egg&cream mixture

chill before using

after chilling, whisk a bit before adding to ice cream maker

140g 90% dark chocolate [I use Lindt]

240g whole milk [I used a rich jersey & guernsey milk]

2 eggs + 1 add'l egg yolk

120g sugar

240g double cream

1t vanilla extract

pinch salt

method

chop chocolate and put in bowl

heat milk in microwave until almost boiling

pour hot milk over chocolate and let sit for a couple minutes

stir milk & chocolate together, should be smooth and melty now [if it is not smooth and melty, you should either panic or cry, or panic then cry, or threaten it with the microwave until it complies]

in separate bowl, which eggs&yolk

whisk in sugar

add dbl cream, vanilla, a hearty pinch of salt and whisk together to mix

mix chocolate into egg&cream mixture

chill before using

after chilling, whisk a bit before adding to ice cream maker

10 July 2013

Short Ribs Cooked For A Very Long Time

.jpg) | |||||||||

| Bought some beef short ribs from Elsco. 2 slabs. Both left on bone. Trimmed one. |

.jpg) |

| Double-bagged both the smoked and the unsmoked, untrimmed control slab of short ribs and cooked them at 55C for 72 hours. |

.jpg) |

| Finished with salt, pepper, butter, and a really hot cast iron pan. |

Got excessive with some short ribs and cooked them sous vide for 72 hours @ 55C, after smoking one set. Result: fantastic! Was not going for a typical braise texture (flakey, falling apart), but rather was aiming for very tender but still a bit steak-like. Was really excellent. The unsmoked version was like a super-tender roast beef. The smoked one, though, was just perfect. |

07 July 2013

Sous Vide Begins

or: "The Inevitability of the Middle Aged Modernist"

I got some new kit to play with. A relatively cheap vacuum packer to start. (The eventual upgrade will be a floorstanding chamber model.) It was only a matter of time before an immersion circulator found its way here.

First thing: steaks! Got some ribeyes from the Ginger Pig, salted each and added a bit of rendered beef fat for no good reason, plus peppered 2 of them. Cooked @ 56C for 6 hours. Finished with a sear in the cast iron pan with butter after dredging in cracked black pepper. Then deglazed the pan with the liquid from the cooking bags and reduced for sauce.

Verdict: excellent! Great flavour as always but much more tender than normal for ribeyes. Big hit with all four of us. Definitely had the "edge to edge" consistency of doneness the method is praised for.

Thoughts: definitely worthwhile. Would use again for tougher cuts of thick steaks to get that lovely tenderness. Might nudge the temp down a little. Probably would not use on fillet mignon, unless using for timing purposes. Also not likely to use for skirt steak/onglet as the finishing sear is not much shorter than how I would normally cook one entirely, but possibly worth an experiment to fiddle with texture.

Next up: eggs. Tried a few temperatures. The well-documented problem with eggs cooked to a precise temperature is that the most people prefer the whites cooked more than the yolk. There are something like 4 main proteins involved in turning an egg into different stages of cookedness and they denature at different temps. Cooking the yolk to an optimal consistency in a water bath will leave the white too soft for most people. Here's what I've discovered so far.

Poached eggs: cook at 62C for 45-60 minutes, then crack into water on low simmer. At this temp, they still crack like raw eggs. Whites are cohesive enough to keep a nice full shape around the yolk. Does not take long to firm them up while leaving the yolk as-is.

Egg for eating as-is: I like 65C. The yolk firms up but still has a rich, satiny texture. The whites are custardy but solid enough to be nice rather than off-putting. Obviously high-quality fresh eggs are a must.

.jpg) |

| New Immersion Circulator: Friend or Foe? Undecided. |

.jpg) |

| Vacuum packing things is really quite fun. Here's some broccoli. |

First thing: steaks! Got some ribeyes from the Ginger Pig, salted each and added a bit of rendered beef fat for no good reason, plus peppered 2 of them. Cooked @ 56C for 6 hours. Finished with a sear in the cast iron pan with butter after dredging in cracked black pepper. Then deglazed the pan with the liquid from the cooking bags and reduced for sauce.

Verdict: excellent! Great flavour as always but much more tender than normal for ribeyes. Big hit with all four of us. Definitely had the "edge to edge" consistency of doneness the method is praised for.

.jpg) |

| 28l of 56C water and 4 ribeyes. |

.jpg) |

| This is a repurposed aquarium. Looks like it's almost fulfilling intended use here. |

Next up: eggs. Tried a few temperatures. The well-documented problem with eggs cooked to a precise temperature is that the most people prefer the whites cooked more than the yolk. There are something like 4 main proteins involved in turning an egg into different stages of cookedness and they denature at different temps. Cooking the yolk to an optimal consistency in a water bath will leave the white too soft for most people. Here's what I've discovered so far.

Poached eggs: cook at 62C for 45-60 minutes, then crack into water on low simmer. At this temp, they still crack like raw eggs. Whites are cohesive enough to keep a nice full shape around the yolk. Does not take long to firm them up while leaving the yolk as-is.

.jpg) |

| Poachy. |

.jpg) |

| And let's vacuum pack a slice of bread. |

13 June 2013

Brisket Day

Last Saturday: Brisket Day.

After 11 months and at least a dozen smoker sessions -- spare ribs, loin ribs, beef ribs, sausages, chicken, pork, turkey, goose, and plenty of duck, plus one chocolate cheesecake -- the time had come for brisket.

I got a genuine packer cut brisket from The East London Steak Company, delivered to me at 6am on a Friday morning. Over 6 kg -- a proper brisket that would be at home in the US. I trimmed off a good bit of fat, so pre-cooking weight was probably around 5.5 kg or so. The trimmed fat was later rendered, strained and saved.

So on Saturday:

05:49 Smoker on. Yes, a very early start. I'd wheeled the smoker out and had it all setup and ready to go the night before. It's about 80kg of metal, not a big back garden theft worry. Trimmed the cut as mentioned, right down to the surface to expose the lovely beef. No rub to speak of, just a generous amount of salt and a little bit of black pepper.

06:25 Brisket on. Temp at grate was about 88C. My plan was to start at relatively low temp then up it over a few hours to a max of around 110C (230F). The wood was a mix of oak and hickory (pellets, cookshack).

08:20 Upped heat. Two hours in, turned the heat up.

09:20 Temp check. Three hours in, temp at grate is about 100C, brisket internal temp about 40C. I upped the controller another 5C and topped up the hopper with some cheaper pellets -- Lil Devils, a blend consisting of, I think, mostly alder and some oak. These are about half the price of the cookshack pellets. After a few hours, not much smoke is getting into the meat anymore. The smoker I have generates all heat by burning pellets so spending the next

10:45 Temp check. Brisket about 51C internal after nearly 4 1/2 hours. Upped the controller another 5C to yield a cooking temp of around 110C. The slow ramp-up seems like a good tactic. Now waiting for the stall. This is the point at which the brisket gets to around 65C. Surface evaporation can keep it at the same temperature for hours, which can cause panic and heat up-turning. This is to be avoided. Either leave it in the smoke and wait it out, or crutch it. We're going to crutch it.

12:45 The stall. The brisket parked itself at 64.7 for a while. So 6 1/2 hours in, time for the crutch. We cut maybe 14th (by weight) off the end -- the thinnest third, the exposed part of the flat -- for two reasons: (1) we wanted to experiment with not crutching, and (b) the thing wouldn't fit into the pan without cutting that off. So with the thin part of the flat still in the smoker, the rest of it, big hunk of meat, went onto a rack in a deep pan, with water under the rack. The whole thing was closely and tightly covered with a few layers of foil then put into the oven, set at 110C.

16:55 Done! 10.5 hours of cooking, with crutch. Aiming for 95C internal. at 65C all the water abandons ship and you get a big piece of shoe-leather, but then the collagen melts and it becomes tender, moist, and delicious again. Ostensibly. We'll see. This was kept wrapped up and left in the oven, cooled down to warm/hold temp. At the same time the much smaller piece in the smoker was still not quite done, although it was past the stall and getting there -- 88C.

17:30 Done (pt 2). The flat remnant in the smoker now 95C. This was covered and put into the warm oven to rest, crammed in below the bigger piece. Now the smoker was upped to 150C to cook a whole mess of sausages and hot dogs.

18:30 Served! First sliced the all-smoker flat. Really nice smoke ring. Kind of dry. Good flavor, and not tough -- fairly tender, but still kind of dry. Then... the big piece. Oh, man. Unbelievable. Incredible flavor, meltingly tender and moist. Was almost hard to slice it was so tender. The whole of the big piece was great, but especially the point (the point!). Wow.

So yes, it was worth it. We declared victory. Brisket Day was a big success and there will be a brisket #2 in the smoker's future.

P.S. I'm having a hard time remembering what I served with it, aside from more meat. Oh yeah, a big pot of pinto beans. And some crisps. And some tomatoes, sliced or chopped or something. And a homemade thousand-island-ish dressing with loads of fresh horseradish I'd prepared while the brisket was smoking. Rolls and tortillas as well, maybe? I didn't want any wheat to get in the way of the meat, so gave that a miss.

P.P.S. There were almost no leftovers. I was expecting a lot. So much that I was going to slice and freeze the leftovers. There was enough for me later to chop it up, fry it in the rendered beef drippings with cracked black pepper and crushed red pepper (mit scharf!) until the edges were dark brown and crispy, then melted cheddar over the top and horseradish/thousand-island dressing and diced tomatoes underneath. Yes.

P.P.P.S. You'd think with an elapsed cooking/prep time of nearly 13 hours I would have had time to take more photos, but no. Next time?

12 June 2013

Pre-Brisket Meat Marshalling: East London Steak Co.

I love my local butcher, but I really liked the looks of ELSco. The perfect excuse for an order came when I picked a Brisket Day: the day I finally put a full brisket into the smoker. It's very difficult to get packer cut brisket from butchers here. Mostly you get rolled brisket. It's either a different cut or just the flat of the same cut, I can't quite tell which, but in either case, it's wrong.

But The East London Steak Co. offer a genuine packer-cut brisket. As I always say, anything worth doing is worth overdoing, so I also ordered some beef sausages, some mahoosive hot dogs, and a few big hunks of short ribs. Deliver was next morning around 6am.

The hot dogs were great. I grilled those on brisket day (anything worth doing, etc.) Not just "good for London" -- hot dogs here are mostly awful, the only passable ones I've found in a grocery store have been Gilbert's Kosher -- but good even for the US. And the brisket? More on that later.

But The East London Steak Co. offer a genuine packer-cut brisket. As I always say, anything worth doing is worth overdoing, so I also ordered some beef sausages, some mahoosive hot dogs, and a few big hunks of short ribs. Deliver was next morning around 6am.

The hot dogs were great. I grilled those on brisket day (anything worth doing, etc.) Not just "good for London" -- hot dogs here are mostly awful, the only passable ones I've found in a grocery store have been Gilbert's Kosher -- but good even for the US. And the brisket? More on that later.

|

| beautifully marbled shortrib |

23 March 2013

Flat Tyre Inside The M25

Snowing in London again this morning. Windy and damp and cold right down into the boots. Nearly at LHR for a drop off when a horrible shuddering high-rpm flopping noise engulfs our little car. Flat tyre on the M4. Joy.

After no luck phoning a couple taxi companies, had instant luck using Hailo. Not kidding: was less than five minutes after a couple clicks in the app. Family not only got to LHR in plenty of time, but the driver called me after dropping them off to let me know they'd made it and to make sure I was ok.

I was, because we have roadside assistance on our insurance. In only about 30 minutes, a cheerful and super-nice guy in a very cool flatbed truck appeared and loaded the aging A2 up and off we went, looking for a tyre shop. We bumbled about a bit before coming upon one in Uxbridge -- a small shop with no bay so the cars worked on sit outside, in the snow. The gent running it said he had a tyre that would fit so the driver unloaded the car and went on to the next stranded motorist.

It would be about an hour before I'd get a new tyre on the wheel, but the man running the shop and doing all the work could not have been nicer. The shop was unheated except for a tiny space heater behind the counter. He made coffee for me and for another guy sitting in the shop, and had me sit behind the counter by the heater (did I mention it was fucking freezing out in the intermittent snow?). The other guy... not sure what his deal was, he didn't seem like he worked there, nor like he was a customer, but he was clearly well known and was a bit of a character. I got the lowdown on a rather eventful trip he took to Brighton once.

Anyway, the incredibly sweet guy doing all the work would take breaks when he could no longer feel his fingers, but got me all sorted out. It cost about 1/3 of what I was expecting. So low I had to check twice that I hadn't misheard. When I was leaving, he asked me if I was from around there. Nope, east end, and I explained how I managed to find myself in his shop. "And you ended up here," he nodded, smiling and serenely satisfied, "it must be fate!" I don't know about that, but as I shook his hand I agreed in spirit -- an unexpectedly warm feeling from what should have been a miserably cold hassle.

After no luck phoning a couple taxi companies, had instant luck using Hailo. Not kidding: was less than five minutes after a couple clicks in the app. Family not only got to LHR in plenty of time, but the driver called me after dropping them off to let me know they'd made it and to make sure I was ok.

I was, because we have roadside assistance on our insurance. In only about 30 minutes, a cheerful and super-nice guy in a very cool flatbed truck appeared and loaded the aging A2 up and off we went, looking for a tyre shop. We bumbled about a bit before coming upon one in Uxbridge -- a small shop with no bay so the cars worked on sit outside, in the snow. The gent running it said he had a tyre that would fit so the driver unloaded the car and went on to the next stranded motorist.

It would be about an hour before I'd get a new tyre on the wheel, but the man running the shop and doing all the work could not have been nicer. The shop was unheated except for a tiny space heater behind the counter. He made coffee for me and for another guy sitting in the shop, and had me sit behind the counter by the heater (did I mention it was fucking freezing out in the intermittent snow?). The other guy... not sure what his deal was, he didn't seem like he worked there, nor like he was a customer, but he was clearly well known and was a bit of a character. I got the lowdown on a rather eventful trip he took to Brighton once.

Anyway, the incredibly sweet guy doing all the work would take breaks when he could no longer feel his fingers, but got me all sorted out. It cost about 1/3 of what I was expecting. So low I had to check twice that I hadn't misheard. When I was leaving, he asked me if I was from around there. Nope, east end, and I explained how I managed to find myself in his shop. "And you ended up here," he nodded, smiling and serenely satisfied, "it must be fate!" I don't know about that, but as I shook his hand I agreed in spirit -- an unexpectedly warm feeling from what should have been a miserably cold hassle.

16 March 2013

In Defense of The Rolled R Crowd

All the years I lived in Chicago I never once went to the top of the Sears tower. I went into the Sears tower, sure -- I was quite fond of Mrs. Levy's Deli -- just never up to the observation decks. But some things are touristy for a good reason. Just because something is popular doesn't mean it's bad. Life in London has made this obvious, repeatedly. Some places are worth going to even though other people also want to go there.

I finally went to see a show at the Globe two summers ago, Much Ado About Nothing. Yes, period costumes and all. Well, it was wonderful (Eve Best's Beatrice especially brilliant).

Neil Steinberg's recent column on a Goodman production of Measure for Measure praises Robert Falls while taking a bit of a swipe at this sort of thing in describing Falls' "lifelong rescue of Shakespeare from the rolled R crowd, returning it the alive thing it was meant to be".

I admit that there should be few theatre-going experiences that feel more contrived than attending a period production in a handbuilt elizabethan replica. Should have been, but wasn't.

It was cool and rainy, as it often is in London in summer. The actors were getting rained on. The yard was getting rained on. Some of the lines became unintentionally ironic, which didn't escape the notice of either the performers or the crowd. The groundlings got some well-deserved attention throughout. A favourite moment: Eve Best delivered a soliloquy kneeling at the edge of the stage, clutching the hand of a woman in the front row. The rain started coming down a bit more heavily. Without breaking character or missing a beat, she reached behind the woman's head and gently pulled her jacket hood up, smoothing it as a big sister would. It pulled the crowd in, enraptured. The whole play became a shared experience, both funnier and more intimate than I ever would have expected.

I like the escapism of theatre and genuinely prefer period versions of period pieces to modern retellings. Being in London in the rain in the Globe... I found the commonality of the experience across the hundreds of years not static and dead but reassuring and life-affirming. Talented actors performing good theatre is always an "alive thing".

I finally went to see a show at the Globe two summers ago, Much Ado About Nothing. Yes, period costumes and all. Well, it was wonderful (Eve Best's Beatrice especially brilliant).

Neil Steinberg's recent column on a Goodman production of Measure for Measure praises Robert Falls while taking a bit of a swipe at this sort of thing in describing Falls' "lifelong rescue of Shakespeare from the rolled R crowd, returning it the alive thing it was meant to be".

I admit that there should be few theatre-going experiences that feel more contrived than attending a period production in a handbuilt elizabethan replica. Should have been, but wasn't.

It was cool and rainy, as it often is in London in summer. The actors were getting rained on. The yard was getting rained on. Some of the lines became unintentionally ironic, which didn't escape the notice of either the performers or the crowd. The groundlings got some well-deserved attention throughout. A favourite moment: Eve Best delivered a soliloquy kneeling at the edge of the stage, clutching the hand of a woman in the front row. The rain started coming down a bit more heavily. Without breaking character or missing a beat, she reached behind the woman's head and gently pulled her jacket hood up, smoothing it as a big sister would. It pulled the crowd in, enraptured. The whole play became a shared experience, both funnier and more intimate than I ever would have expected.

I like the escapism of theatre and genuinely prefer period versions of period pieces to modern retellings. Being in London in the rain in the Globe... I found the commonality of the experience across the hundreds of years not static and dead but reassuring and life-affirming. Talented actors performing good theatre is always an "alive thing".

03 March 2013

Future, Forwards, Kittens, Swaps, How Many Were Going to St. Ives?

There was a discussion on huffpo live the other week about futures and "the futurization of swaps" [scary! buy another AR-15!]. The panel was good but from the comments and questions it's clear there is a ton of confusion around basic concepts and terminology.

Derivatives

A nebulous term that pretty much covers any financial instrument (think "tradeable") whose value is derived from something else (an "underlying"). Yeah, I know, that's not particularly helpful. It's easier to understand by example. If I buy a truckload of corn from you, that's not a derivative. If you and I agree that I will buy corn from you exactly one year from now for a specific price, that's a derivative. If you buy stock, that's not a derivative. If you buy a simple option on stock, that's a derivative. Derivatives can be really simple and straightforward, like those examples, or they can be so complex that almost no one, including the people pricing and trading them, can understand them. Blanket claims about derivatives being destructive or evil should be avoided. Warren Buffet had a quote about derivatives being "weapons of financial mass destruction" that gets universally misunderstood and overused. He wasn't talking about stock options or currency forwards.

Swaps

Speaking of misunderstood and overused, how 'bout those "swaps"? This word gets used interchangeably, as if interest rate swaps, fx swaps, asset swaps, credit default swaps, and so on were all the same thing. They're not.

First, let's make up a new type of swap: The NBA Scoring Rate Swap, the "SRS". This will be based on two numbers: one is a fixed number that we simply set and agree on, the other is a variable number based on real-world observations. The difference between the fixed number and the observed/variable number will be used to see who pays whom what. In our SRS, we'll say that the variable number is the number of points scored by a particular NBA team in each game. The fixed number can be anything we want. So maybe you're interested in an SRS on the New York Knicks. We'll set the fixed scoring rate at 100 points per game. The variable scoring rate will be however many points the Knicks score in each game. Suppose you're the client and I'm the dealer and you come to me wanting to enter into an SRS agreement on the Knicks. You can either "pay" the fixed number and thus "receive" the variable number, or vice versa. I'm a dealer, I don't really care. But if you want the SRS based on a specific fixed number, I'll price it up based on my forecasting models for how many points per game the Knicks are going to score, and depending on the difference between that and our agreed fixed points per game, there might be a fee involved in entering into this deal.

So anyway, say you want to pay me a fixed scoring rate of 100 points per game, and receive from me however many points the Knicks actually score in each game, and we agree that each point is worth $1. My models forecast that the Knicks will score 99 points per game, so I think I'm likely to make money from this and thus we enter this agreement at no charge to you. So how does this work? Well, in game 1 of the season the Knicks score 104 points, so I pay you $4. Prior to game 1 we knew that you'd pay me $100 regardless, and I'd have to pay you $1/point once the game was over and the variable number for that game became known. To not be tedious we net the numbers and exchange only the difference. In game 2, the Knicks score 100 points and no money changes hands. In game 3 the Knicks only score 88 points so you pay me $12. And so on for the entire season.

So we entered into an agreement such that each Knicks game would end up generating a cash flow between the two of us, and that cash flow would be based on the difference between the points they score in each game and 100. Why would you want to do this? I have no idea, and as a dealer I don't really care. My *sales* staff might care. They might come up with a variety of reasons why you should want to do this. Maybe you run a taco stand and have a promotion to give away some food whenever the Knicks score more than 100 points in a game so want to hedge your losses. Or maybe you have a view that the Knicks will score better than everyone expects and want to try to make some money from this view. Doesn't really matter.

So that's a pretty simple swap and we can probably agree that doesn't seem particularly nefarious. We might touch on this example later as we look into collateral, but for now let's talk about some real swaps.

FX swaps: "FX" stands for "foreign exchange" and means currencies. [Possibly a topic for another post, but I think the notion of exchange rates and how they are "set" via the workings of a free market is completely baffling to a large number of people.] And FX swap is exchanging currencies now(ish) and later exchanging them back (more or less). I'll buy some ££ from you this week, paying you in $$, and 3 months from now I'll sell you back ££ and you'll give me $$. Why we'd do this and how we determine the exchange rates doesn't really matter, the point is that basic FX Swaps are simple things and even Warren Buffet doesn't lose any sleep over them.

Interest Rate Swaps: a basic interest rate swap (IRS) is similar to our SRS, above. One side pays or receives based on a fixed interest rate while the other side receives or pays based on a variable ("floating") interest rate. Anyone who has looked at mortgages should be able to understand this. Maybe you want to exchange the uncertainty of variable cash payments for something fixed. These can be pretty straightforward and not very evil. Variations, on the other hand, can be fiendishly complex, especially when various types of interest rate instruments are "structured" into a single complicated deal.

While basic interest rate swaps can be pretty easy to describe and understand, they can still cause trouble if entered into by people who don't fully grasp the ramifications of the agreement. Many of them last for many years and are sometime regretted. In the US, municipalities are allowed to enter into agreements that, probably sensibly, local governments in other countries (e.g. UK) are prohibited from. Interest rate swaps can be made arbitrarily complex and terms can be obfuscated and dealers can "mis-sell" them. Local governments and unsophisticated business entering into complex deals with investment banks are kind of like a gambling neophyte stumbling into a smokey back room at an illegal club and misinterpreting the welcoming smiles of the poker players around the table as friendliness. There's been no shortage of irresponsible behaviour around all sides of that table.

Credit Default Swaps: now we're talking. I don't know why these are called "swaps". Here's the simplest way to understand them: they are default insurance. If you buy "protection" in the form of a Credit Default Swap (CDS), you are buying insurance to pay you in the event of a company defaulting on its debt obligations. This makes a tremendous amount of sense if you have actually lent that company some money (by buying its bonds, say), in which case, you have an insurable interest. Suppose you have no insurable interest in that company. Why are you allowed to buy insurance on it without an insurable interest? I have no idea. You are not allowed to buy home insurance on your neighbour's home, for hopefully obvious reasons. Suppose an employee of yours takes out a big car loan. Should you be allowed to buy insurance such that if he misses a loan payment you make some money? Welcome to the world of CDSs. So these are pretty simple conceptually but very strange in practice. And I hope it's clear that there's a pretty big difference between a CDS, an IRS, an FX Swap, and an SRS such that using a blanket term "Swaps" when trying to have a meaningful discussion about, say, industry reform, can be counterproductive.

So what's all this about "futurization" and exchanges and such?

Let's forget about swaps for a moment and look at some more terminology.

Futures & Forwards

If you and I agree that 6 months from now I will buy 100 gallons of frozen orange juice concentrate from you for $1000, that's a forward. If we did that on an exchange, we'd call it a future. When we're talking about futures, we're using shorthand for a whole bunch of features that come with something being a "future" rather than a bespoke "over the counter" [OTC] agreement. Being a future implies the product is regulated, standardized, and is valued (maybe) and margined (definitely) differently. More on that in a minute.

Collateral

Suppose we've done the Knicks Scoring Rate Swap above and, shortly after agreeing on the deal, the top 3 scorers on the Knicks all get lost for the season to injury and the coach announces a new "defense first" philosophy. Looks like their scoring will go way down, and you'll potentially be owing me a lot of money. My calculation of the theoretical value of the deal now shows it is worth much more to me, but I'm worried about actually realizing all that profit. So I ask you to post collateral with me. This is pretty similar to a loan, in that I think you owe me a lot of theoretical money in the future, so have effectively extended credit to you, and want you to post collateral with me as a bit of protection. Suppose further that 2 weeks into the season the remaining good scorer on the Knicks is traded for a defensive specialist. I think the value of the deal is even more in my favor, and I calculate the difference in collateral I think you should post to me, and politely tell you about it (margin call!).

This could have easily gone the other way -- with the Knicks dumping all their defensive players, hiring a "shoot early and often" coach -- in which case you would want collateral from me. If I'm a big SRS dealer and you're a small client, I would never want to have to post collateral to you but would require it from you. So you don't have any way to mitigate the risk of dealing with me as a counterparty but hey, I'm a big bank, what's the worst that can happen? If by contract or regulation we each have to post collateral to each other this is a "bilateral" agreement. This is much more common now than it was six years ago, as you might guess.

So getting back to futures: when you trade a future you have to post collateral based on an initial margin calculation and then you pay or receive funds every single day based on the new value of the thing you've traded. (Valuing by observed traded prices is called "marking to market". Valuing by whatever method you invent is "marking to model".) So if we've entered 6-month frozen orange juice concentrate futures contract each of us will pay or receive based on the price fluctuations daily. The price could fluctuate massively but since we settle up each day, rather than at the end, the risk of not getting settlement (all the things ultimately owed) is greatly mitigated.

Exchanges

If we do "exchange clearing" or settle via "clearinghouses", what this means is that a central body -- exchange/clearinghouse -- becomes the counterparty. If you do the initial trade on an exchange, rather than over-the-counter, settling this way is part of the bargain. But it is possible -- and in the future will be increasingly mandatory -- to do a trade over the counter but then move ("novate") the trade to a clearinghouse to deal with the rest of the life of that trade as far as settlement is concerned. What this really means is that you no longer care who you did the trade with, the central body becomes your counterparty. If First Bank of Rufus goes bankrupt you don't care, the exchange still makes good on the money owed to you for the rest of the life of the SRS or the Frozen Orange Juice Concentrate Future or whatever other things we'd traded but moved onto the exchange for settling.

So rather than having to manage counterparty risk and collateral agreements with every single entity you trade with, an advantage of the exchange model is that you really only face off with 1 -- the exchange.

So what's "futurization" then?

Well, there are a couple aspects. One is simply requiring clearinghouses to deal with settlement. The other is going farther and requiring standardization of instruments so the traded instruments are more fungible and observable.

One More Word On Collateral

This post has really gotten out of hand and is most likely incomprehensible because I can't be bothered to edit or rewrite it, but one important thing to understand about collateral: different collateral has different "quality". If you get a collateralized loan at your bank the bank will discount ("haircut") the value of what you're signing over to them as collateral. If you use your car, they might discount 50% vs. blue book value. Your house might be discounted much less. Your beer can collection much more. The entity effectively extending credit can be as flexible as they want on what they take as collateral, but they discount based on quality.

Unfortunately, exchanges are going the way of accepting only very high quality collateral rather than simply accepting a range of quality and haircutting appropriately (we're talking bonds here mostly, not cars, jewelry, or houses). This demand for high-quality collateral has some bad effects -- actually increases systemic risk and decreases transparency, but that's a topic for another day.

Derivatives

A nebulous term that pretty much covers any financial instrument (think "tradeable") whose value is derived from something else (an "underlying"). Yeah, I know, that's not particularly helpful. It's easier to understand by example. If I buy a truckload of corn from you, that's not a derivative. If you and I agree that I will buy corn from you exactly one year from now for a specific price, that's a derivative. If you buy stock, that's not a derivative. If you buy a simple option on stock, that's a derivative. Derivatives can be really simple and straightforward, like those examples, or they can be so complex that almost no one, including the people pricing and trading them, can understand them. Blanket claims about derivatives being destructive or evil should be avoided. Warren Buffet had a quote about derivatives being "weapons of financial mass destruction" that gets universally misunderstood and overused. He wasn't talking about stock options or currency forwards.

Swaps

Speaking of misunderstood and overused, how 'bout those "swaps"? This word gets used interchangeably, as if interest rate swaps, fx swaps, asset swaps, credit default swaps, and so on were all the same thing. They're not.

First, let's make up a new type of swap: The NBA Scoring Rate Swap, the "SRS". This will be based on two numbers: one is a fixed number that we simply set and agree on, the other is a variable number based on real-world observations. The difference between the fixed number and the observed/variable number will be used to see who pays whom what. In our SRS, we'll say that the variable number is the number of points scored by a particular NBA team in each game. The fixed number can be anything we want. So maybe you're interested in an SRS on the New York Knicks. We'll set the fixed scoring rate at 100 points per game. The variable scoring rate will be however many points the Knicks score in each game. Suppose you're the client and I'm the dealer and you come to me wanting to enter into an SRS agreement on the Knicks. You can either "pay" the fixed number and thus "receive" the variable number, or vice versa. I'm a dealer, I don't really care. But if you want the SRS based on a specific fixed number, I'll price it up based on my forecasting models for how many points per game the Knicks are going to score, and depending on the difference between that and our agreed fixed points per game, there might be a fee involved in entering into this deal.

So anyway, say you want to pay me a fixed scoring rate of 100 points per game, and receive from me however many points the Knicks actually score in each game, and we agree that each point is worth $1. My models forecast that the Knicks will score 99 points per game, so I think I'm likely to make money from this and thus we enter this agreement at no charge to you. So how does this work? Well, in game 1 of the season the Knicks score 104 points, so I pay you $4. Prior to game 1 we knew that you'd pay me $100 regardless, and I'd have to pay you $1/point once the game was over and the variable number for that game became known. To not be tedious we net the numbers and exchange only the difference. In game 2, the Knicks score 100 points and no money changes hands. In game 3 the Knicks only score 88 points so you pay me $12. And so on for the entire season.

So we entered into an agreement such that each Knicks game would end up generating a cash flow between the two of us, and that cash flow would be based on the difference between the points they score in each game and 100. Why would you want to do this? I have no idea, and as a dealer I don't really care. My *sales* staff might care. They might come up with a variety of reasons why you should want to do this. Maybe you run a taco stand and have a promotion to give away some food whenever the Knicks score more than 100 points in a game so want to hedge your losses. Or maybe you have a view that the Knicks will score better than everyone expects and want to try to make some money from this view. Doesn't really matter.

So that's a pretty simple swap and we can probably agree that doesn't seem particularly nefarious. We might touch on this example later as we look into collateral, but for now let's talk about some real swaps.

FX swaps: "FX" stands for "foreign exchange" and means currencies. [Possibly a topic for another post, but I think the notion of exchange rates and how they are "set" via the workings of a free market is completely baffling to a large number of people.] And FX swap is exchanging currencies now(ish) and later exchanging them back (more or less). I'll buy some ££ from you this week, paying you in $$, and 3 months from now I'll sell you back ££ and you'll give me $$. Why we'd do this and how we determine the exchange rates doesn't really matter, the point is that basic FX Swaps are simple things and even Warren Buffet doesn't lose any sleep over them.

Interest Rate Swaps: a basic interest rate swap (IRS) is similar to our SRS, above. One side pays or receives based on a fixed interest rate while the other side receives or pays based on a variable ("floating") interest rate. Anyone who has looked at mortgages should be able to understand this. Maybe you want to exchange the uncertainty of variable cash payments for something fixed. These can be pretty straightforward and not very evil. Variations, on the other hand, can be fiendishly complex, especially when various types of interest rate instruments are "structured" into a single complicated deal.

While basic interest rate swaps can be pretty easy to describe and understand, they can still cause trouble if entered into by people who don't fully grasp the ramifications of the agreement. Many of them last for many years and are sometime regretted. In the US, municipalities are allowed to enter into agreements that, probably sensibly, local governments in other countries (e.g. UK) are prohibited from. Interest rate swaps can be made arbitrarily complex and terms can be obfuscated and dealers can "mis-sell" them. Local governments and unsophisticated business entering into complex deals with investment banks are kind of like a gambling neophyte stumbling into a smokey back room at an illegal club and misinterpreting the welcoming smiles of the poker players around the table as friendliness. There's been no shortage of irresponsible behaviour around all sides of that table.

Credit Default Swaps: now we're talking. I don't know why these are called "swaps". Here's the simplest way to understand them: they are default insurance. If you buy "protection" in the form of a Credit Default Swap (CDS), you are buying insurance to pay you in the event of a company defaulting on its debt obligations. This makes a tremendous amount of sense if you have actually lent that company some money (by buying its bonds, say), in which case, you have an insurable interest. Suppose you have no insurable interest in that company. Why are you allowed to buy insurance on it without an insurable interest? I have no idea. You are not allowed to buy home insurance on your neighbour's home, for hopefully obvious reasons. Suppose an employee of yours takes out a big car loan. Should you be allowed to buy insurance such that if he misses a loan payment you make some money? Welcome to the world of CDSs. So these are pretty simple conceptually but very strange in practice. And I hope it's clear that there's a pretty big difference between a CDS, an IRS, an FX Swap, and an SRS such that using a blanket term "Swaps" when trying to have a meaningful discussion about, say, industry reform, can be counterproductive.

So what's all this about "futurization" and exchanges and such?

Let's forget about swaps for a moment and look at some more terminology.

Futures & Forwards

If you and I agree that 6 months from now I will buy 100 gallons of frozen orange juice concentrate from you for $1000, that's a forward. If we did that on an exchange, we'd call it a future. When we're talking about futures, we're using shorthand for a whole bunch of features that come with something being a "future" rather than a bespoke "over the counter" [OTC] agreement. Being a future implies the product is regulated, standardized, and is valued (maybe) and margined (definitely) differently. More on that in a minute.

Collateral

Suppose we've done the Knicks Scoring Rate Swap above and, shortly after agreeing on the deal, the top 3 scorers on the Knicks all get lost for the season to injury and the coach announces a new "defense first" philosophy. Looks like their scoring will go way down, and you'll potentially be owing me a lot of money. My calculation of the theoretical value of the deal now shows it is worth much more to me, but I'm worried about actually realizing all that profit. So I ask you to post collateral with me. This is pretty similar to a loan, in that I think you owe me a lot of theoretical money in the future, so have effectively extended credit to you, and want you to post collateral with me as a bit of protection. Suppose further that 2 weeks into the season the remaining good scorer on the Knicks is traded for a defensive specialist. I think the value of the deal is even more in my favor, and I calculate the difference in collateral I think you should post to me, and politely tell you about it (margin call!).

This could have easily gone the other way -- with the Knicks dumping all their defensive players, hiring a "shoot early and often" coach -- in which case you would want collateral from me. If I'm a big SRS dealer and you're a small client, I would never want to have to post collateral to you but would require it from you. So you don't have any way to mitigate the risk of dealing with me as a counterparty but hey, I'm a big bank, what's the worst that can happen? If by contract or regulation we each have to post collateral to each other this is a "bilateral" agreement. This is much more common now than it was six years ago, as you might guess.

So getting back to futures: when you trade a future you have to post collateral based on an initial margin calculation and then you pay or receive funds every single day based on the new value of the thing you've traded. (Valuing by observed traded prices is called "marking to market". Valuing by whatever method you invent is "marking to model".) So if we've entered 6-month frozen orange juice concentrate futures contract each of us will pay or receive based on the price fluctuations daily. The price could fluctuate massively but since we settle up each day, rather than at the end, the risk of not getting settlement (all the things ultimately owed) is greatly mitigated.

Exchanges

If we do "exchange clearing" or settle via "clearinghouses", what this means is that a central body -- exchange/clearinghouse -- becomes the counterparty. If you do the initial trade on an exchange, rather than over-the-counter, settling this way is part of the bargain. But it is possible -- and in the future will be increasingly mandatory -- to do a trade over the counter but then move ("novate") the trade to a clearinghouse to deal with the rest of the life of that trade as far as settlement is concerned. What this really means is that you no longer care who you did the trade with, the central body becomes your counterparty. If First Bank of Rufus goes bankrupt you don't care, the exchange still makes good on the money owed to you for the rest of the life of the SRS or the Frozen Orange Juice Concentrate Future or whatever other things we'd traded but moved onto the exchange for settling.

So rather than having to manage counterparty risk and collateral agreements with every single entity you trade with, an advantage of the exchange model is that you really only face off with 1 -- the exchange.

So what's "futurization" then?

Well, there are a couple aspects. One is simply requiring clearinghouses to deal with settlement. The other is going farther and requiring standardization of instruments so the traded instruments are more fungible and observable.

One More Word On Collateral

This post has really gotten out of hand and is most likely incomprehensible because I can't be bothered to edit or rewrite it, but one important thing to understand about collateral: different collateral has different "quality". If you get a collateralized loan at your bank the bank will discount ("haircut") the value of what you're signing over to them as collateral. If you use your car, they might discount 50% vs. blue book value. Your house might be discounted much less. Your beer can collection much more. The entity effectively extending credit can be as flexible as they want on what they take as collateral, but they discount based on quality.

Unfortunately, exchanges are going the way of accepting only very high quality collateral rather than simply accepting a range of quality and haircutting appropriately (we're talking bonds here mostly, not cars, jewelry, or houses). This demand for high-quality collateral has some bad effects -- actually increases systemic risk and decreases transparency, but that's a topic for another day.

02 March 2013

Basic Cheese Sauce

Very simple. So far, works great with cheddar or parmesan. No reason other cheeses wouldn't work. No need to use a melting-friendly cheese (neither good cheddar nor parmesan melt particularly well). Basically just a bechamel with cheese added at the end.

30g butter

30g flour

salt & pepper

500ml whole milk

100g cheese

melt butter

stir in flour and cook a bit over low heat

[optional] heat up the milk in the microwave until hot

whisk hot milk into butter & flour, off of heat

put back on heat and stir until boiling and thickened

take off heat, add cheese, stir gently until smooth and creamy

add the salt & pepper at any step in which you remember to do so, but keep in mind some cheeses can be quite salty so it's fine to save it for the end

can put it on low heat during the cheese melting stage if needed, but don't boil it once the cheese has gone in

shredding the cheese works better than dicing

30g butter

30g flour

salt & pepper

500ml whole milk

100g cheese

melt butter

stir in flour and cook a bit over low heat

[optional] heat up the milk in the microwave until hot

whisk hot milk into butter & flour, off of heat

put back on heat and stir until boiling and thickened

take off heat, add cheese, stir gently until smooth and creamy

add the salt & pepper at any step in which you remember to do so, but keep in mind some cheeses can be quite salty so it's fine to save it for the end

can put it on low heat during the cheese melting stage if needed, but don't boil it once the cheese has gone in

shredding the cheese works better than dicing

02 January 2013

The Gooben! (Geuben?)

New Year's Day main course: goose-breast reubens. Goose breasts were soaked in a heartily spiced brine for 12 hours, dried overnight, then hot-smoked for a few hours before chilling for a few days. Then shaved in the slicer, fried with black pepper, and heaped onto grilled homemade caraway rye, with melted swiss, sauerkraut, and a homemade dressing (mayo, worcestershire, hot sauce, minced red bell pepper, minced onion, dash of ketchup, sweet pickle relish, freshly grated horseradish root).

Wow were they good. Goose is beefy to start with, lovely grass-fed birds they are. The slightly cured and smoked goose breast had a lovely deep burgundy coloring and an aromatic smokiness reminiscent of pastrami. This really came out as it heated on the griddle with butter and black pepper, the edges crisping up baconly. I'm almost getting hungry again.

.jpg)

.jpg)

.jpg)

.jpg)